Starting Your Own Business

- Financial Obligations

- Budgeting for Tax

- Record Keeping

Financial Obligations

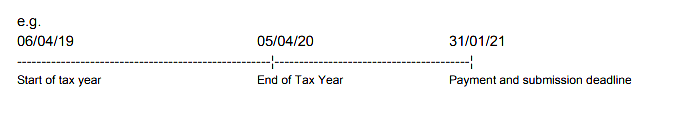

Example financial year

As a newly self-employed individual you will need to register as self-employed with HMRC. Click here to start your registration process. Alternatively we can complete this for you for a oneoff fee of £50.

The tax year runs from 6th of April to 5th April the following year and you are required to submit a self-assessment tax return each year. Once the tax year ends on the 5th April you will have until 31 Jan the following year to submit your tax return and pay any outstanding liabilities.

Budgeting for your tax

It can be difficult to budget for your tax in the first year as you will not know how much profit you will make. A good way to estimate your tax would be to save 20% of your income. This will no doubt be too much but it’s a good place to start. If you would like a more detailed calculation we can produce a forecast for you as part of your fee, although this will increase your monthly bill slightly I will most definitely prepare you and stop any nasty surprises when we come to do you final calculations.

Payments on Account

In your first year you may have to pay not only your liability for the tax year but also make a contribution towards the next tax year. This will depend on the final liability of the year and if you have any other income that has already been tax in that year.

If you have a liability of over £1,000 this will trigger payments on account’. This is where HMRC estimates that you will pay the same amount tax in the next year and asks for up front payments. 50% in January along with you balancing payment for the previous year and a further 50% in July.

1st year example

Tax liability for 19/20

1st Payment on Account for 20/21

Total due to be paid

2nd Payment on Account

£1,000

£500

£1,500 by 31/01/21

£500 by 31/07/21

The payments on account you make will be offset against your next year’s tax and hopefully there will only be a small top up to pay if your profits are similar.

2nd year example

Tax liability for 20/21

1st Payment on Account for 21/22

Total due to be paid

Payments made

Balance due

2nd Payment on Account for 21/22

£1,100

£550

£1,650 by 31/01/22

(£1000)

£650 by 31/01/22

£550 by 31/07/22

Losses

If in your first year you make a loss, don’t be disheartened! Lots of businesses make a loss in the first year, this is mainly because there are a lot of one off set up costs that you have to fork out for, but these costs won’t be there next year making profits a lot healthier.

If you make a loss during the year these will be able to be utilised but how will all depend on your circumstances, another reason to appoint an accountant. We will know a lot of little ‘tricks of the trade’ to fully take advantage of the tax rules.

Record Keeping

There are many ways to keep records of your income and expenses. The key thing to remember, the more record keeping you do the lower your accountancy fee will be.

Computerised Accountancy Software

There are a number of packages out there for you to use, but we have detailed below our recommendations:

- Xero

- Online cloud accounting

- App available

- Accountants access available

- Recurring invoices

- Attach copies of invoices to transactions to remove the need to keep hold of paper copies of receipts/invoices

- ReceiptBank

- App to collect all receipts

- Will integrate with Xero to import

- Automatically pulls information off the invoice to be able to put straight in to you cloud accounting software or for your accountant to extract for accounts preparation

With the above two products, you can choose to use both, or choose to use one. If you are a limited company you will need to have a more sophisticated accounts recording system, but as a sole trader you will not.

We are able to provide training and advice for the above two options and provide limited advice on others. You do not have to use the above*, it’s your business, it’s your choice.

*If your turnover is or is going to reach the VAT threshold you will be required to use computerised accounting system to comply with Making Tax Digital rules, click here to find out more

01

02

Cashbook

There is nothing to say you cannot use the old fashioned pen and paper, there are many companies out there that produce manual cashbooks, it is simple and effective, but it is only effective if it is complete and totalled.

It is important to total everything and use the books to their full potential. You will need to make sure you have separated your income and your expenses, some books have one side for income and one side for expenses, other you would need to have separate books, both options will be available from most reputable stationery retailers.

Spreadsheet

If you wish to record your accounts on a spreadsheet we can provide you with a template but you will find that, depending on your software package, they may have a template for you to use.

Again as long as you are recording your income and expenses (and bank transactions for limited companies) you will be good to go!

everything and use the books to their full potential. You will need to make sure you have separated your income and your expenses, some books have one side for income and one side for expenses, other you would need to have separate books, both options will be available from most reputable stationery retailers.

Making Tax Digital (MTD)

Making Tax Digital is a key part of the government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.

Eventually all businesses and individuals will be required to report their income periodically.

Currently, if your business is VAT registered you have to submit your VAT return via MTD compliant software. There are many companies out there that can provide the solutions but here at Sole Accountancy Services we actively promote and recommend Xero.

Xero have special offers that come up all the time but we recommend the standard package as there are no restrictions on the number of items you can process. If you have bank accounts in multiple currencies then you will need to upgrade to the premium package to be able to reconcile your transactions correctly.

There are a number of other options and we will be more than happy to help you whatever you decide.